Where To Send Your Cap Payouts

With floating rates already climbing above 0.50% this quarter and markets projecting a continued increase all the way up to 3.40% by this time next year, many interest rate caps are about to start paying out. This has left many borrowers, and some lenders, asking the question: where do the cap payouts go?

The answer is “it depends.” Because most interest rate caps are a prerequisite for a loan closing, the borrower will usually be required to assign the hedge to the lender as collateral. Most of the time, that Collateral Assignment will also stipulate to which account cap payouts are to be sent. There are generally a couple ways those payouts can be processed:

-

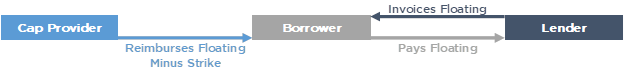

Cap payouts go directly to the borrower.

-

The payout is sent from the cap provider to the borrower’s account, who then nets that amount against the floating rate invoice from their lender.

-

-

Cap payouts go directly to the lender.

-

The payout is sent from the cap provider to the lender’s account.

-

The lender subtracts the cap payout from the floating rate interest, and invoices for the net amount.

-

Or, the lender invoices the floating rate amount and reimburses the cap payout.

-

That reimbursement could potentially be applied to the next payment, which would create a one-period lag on when the borrower receives those funds.

-

-

-

The below graphically illustrates how approach #1, which is far more common, works.

If your interest rate cap wasn’t a lender requirement and also wasn’t assigned to the lender as collateral following execution, you should be free to direct the cap payouts to the account of your choosing. Most borrowers in this scenario will have the payouts sent to an operating account or the account from which the loan payments are sent for that deal.

If your interest rate cap was a lender requirement and you’re not sure where the payouts will go, a good first step would be to take a look at the Collateral Assignment and see if it’s specified there. If it’s not, it may be worth checking with your lender to ensure that they’re indifferent to the account before providing wiring instructions for your cap provider.

If you have any questions or need assistance identifying where you interest rate cap payouts should go, please don’t hesitate to reach out to the Pensford team at pensfordteam@pensford.com or (704) 887-9880.