The Bottom Will Drop Out Next Year

Last week, I summoned my inner Shakespeare as an homage to the chaos in England. What I didn’t know at the time was how much worse it really was. Rates were surging because of the terrible budget proposed by the new government, right?

Turns out, rates were surging because England’s biggest pension funds were on the verge of collapsing. As rates climbed, these pension funds were forced to liquidate their sovereign holdings. By selling, they put more upward pressure on yields, forcing more selling, and so on and so forth.

Although the Fed doesn’t want to blink, I believe it will have to if cracks like this continue to show. CNBC’s Ron Insana recounted a discussion with Fed Chair Greenspan about allowing Long Term Capital fail in the late 1990’s.

Greenspan agreed that he preferred to allow markets to handle LTC’s collapse, but “in practice it’s not a social experiment I’m willing to undertake.”

While Powell will continue hammering home the message the Fed won’t blink, the Chair doth protest too much, me thinks. Powell might have the stomach for a bear stock market and some job losses, but what about systemic financial risk?

In today’s newsletter, we discuss how rates behave once the Fed stops hiking.

Here’s a hint – the bottom falls out.

Last Week This Morning

- 10 Year Treasury at 3.89%

- German bund up to 2.19%

- 2 Year Treasury at 4.31%

- LIBOR at 3.31%

- SOFR at 3.05%

- Term SOFR at 3.27%

- Nonfarm Payrolls came in at 263,000 vs expected 250,000

- The unemployment rate dropped back to 3.5%, but only because the participation rate dropped

- Average hourly earnings were up 5% (this is the wage inflation spiral Powell is so focused on)

- Job openings dropped by 1.1mm, the largest drop since the first month of the covid shutdowns

Random Thought of the Day

Locking in fixed rate for a 10 year hold always makes a lot of sense to me, but locking in today just because floating rates have spiked unexpectedly doesn’t necessarily make sense.

You aren’t just locking in 10 year rates – you are locking in extremely conservative lending terms. What happens when you want to refinance in 2 or 3 years with more reasonable lending terms?

Does the Canary in the Coal Mine Have a British Accent?

Turns out the stuff in England was way worse than we thought. Remember last week when I said, “There’s a surprise, closed door Fed meeting today and I wonder what that’s about?” They still haven’t said it, but I would bet an English countryside manor it was about the potential meltdown across the pond.

From The Guardian (1)

Had the Bank not intervened with a promise to buy up to £65bn of government debt, funds managing money on behalf of pensioners across the country “would have been left with negative net asset value” and cash demands they could not have met.

Explaining its emergency intervention to calm turmoil in financial markets last week, the central bank said pension funds with more than £1tn invested in them came under severe strain with a “large number” in danger of going bust.

“As a result, it was likely that these funds would have to begin the process of winding up the following morning,” the Bank said.

The central bank said the meltdown was at risk of rippling through the UK financial system, which could have then caused “excessive and sudden tightening of financing conditions for the real economy”.

“We are at the center of the storm now,” said Calum Mackenzie, investment partner at Aon, who said he is aware of significant sales of liquid assets in the market. “The storm is moving and it will sweep up other parts of the market.”(2)

This is 2008 type stuff. The BoE says the emergency measures expire at week end, but let’s see if they have to extend the purchases.

Also, expect more selling of corporate debt now that these pension funds have rebalanced their portfolios. They still need to liquidate for financial reasons, but they also have mandates to maintain a certain percentage of their portfolios in sovereign debt. The ripple effects are only just now beginning to be felt.

The Fed Will Blink Soon…They Just Don’t Know It Yet

Markets are expecting another 75bps hike at next month’s meeting. Not me. I think it will be 50bps, even though this week’s CPI reading may lead to more calls for 75bps.

Why are we all behaving like there’s no lag in these decisions? The difference between 50bps and 75bps will have no impact on next month’s inflation data. The Fed has already tightened massively this year, it’s time to shift gears into evaluation mode and let the impact catch up.

Inflation may not be cooling off as fast as the Fed would like, but if the events in England are any sign, the massive tightening is starting to create cracks in the system. How long before emerging market chaos, created by a strengthening dollar, are in the headlines? What other hidden issues like the British pension funds are lurking?

The Fed should be taking these cracks seriously. It can use the November meeting to slowly begin easing off the brakes, by downshifting from 75bps to 50bps. That’s still a lot of tightening.

Super-genius Larry Summers disagrees. “It’s a real mistake to suggest that somehow we shouldn’t do the monetary policies that are necessary to avoid inflation becoming entrenched because of concerns about financial stability,” Summers told Bloomberg. “There’s risk of some kind of financially traumatic event. But I think the chances of something that is large enough to divert the Fed are really quite low.”

Regardless, rates are likely to plunge in the second half of next year.

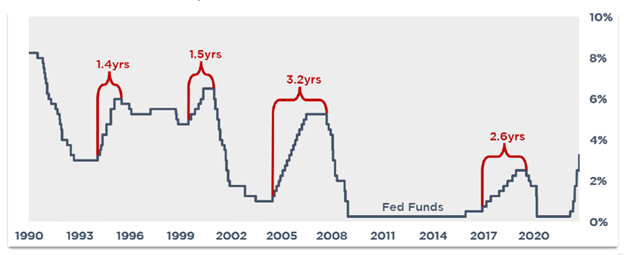

At the start of the year, we published this graph illustrating the time from the first hike to the first cut. It became the single most clicked on graph we’ve ever created, beating out the hairy chart (click here) and yield curve inversion (click here). The average length of time from first hike to first cut is just over two years, which would put the first cut March 2024.

The Fed will pause at some point, but what comes next? The Fed and the market (via the forward curve) both suggest SOFR will stay above 3% for the next 3 years. Yet here I am, already talking about the bottom falling out?

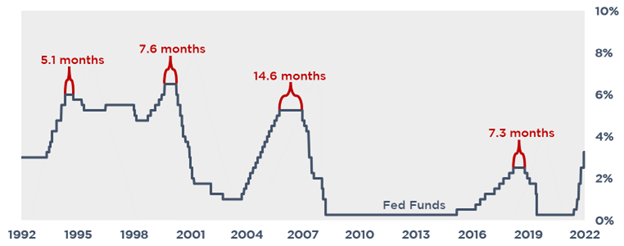

We created a new graph to tackle the question of what comes next.

After the last hike, how long before the Fed starts cutting?

- Average: 8.7 months

- Shortest: 5.1 months

- Longest: 14.6 months

If the Fed pauses soon, history tells us they will be cutting in 2023.

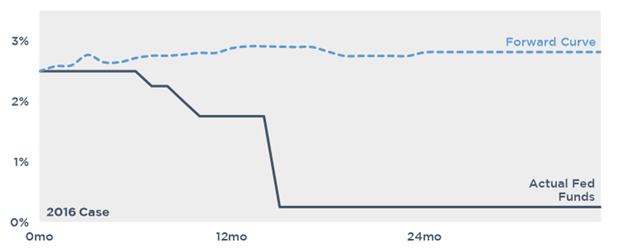

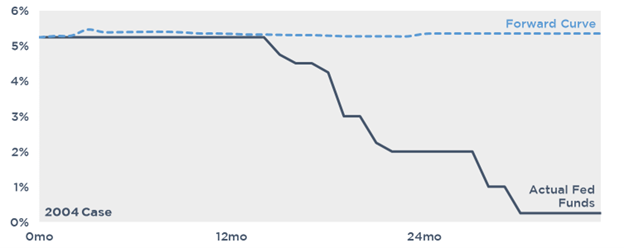

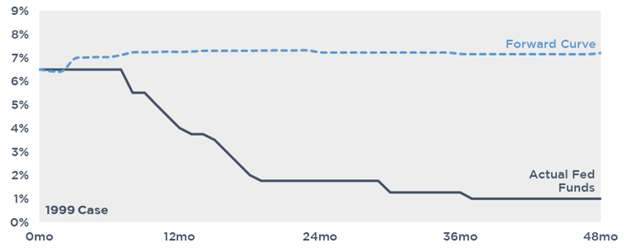

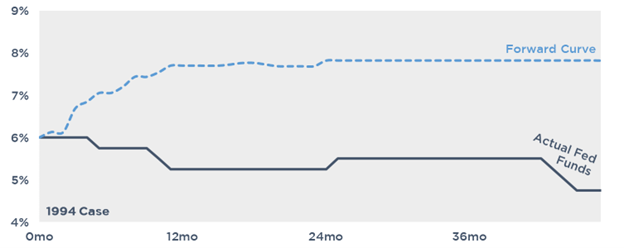

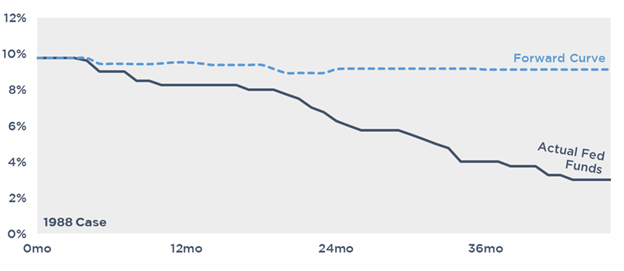

We also investigated each cycle independently. The following graphs compare the forward curve the day of the last hike vs what ultimately ends up happening.

The market generally believes that rates will remain flat for at least 3 years, but they always fall.

2016 Tightening Cycle

Remember, the dashed forward curve is from the day of the last hike. The solid black line is what ended up happening.

The market expected rates to basically be flat, but the bottom fell out.

2004 Tightening Cycle

The market expected rates to be flat, but the bottom fell out.

1999 Tightening Cycle

The market expected rates to be flat, but the bottom fell out.

1994 Tightening Cycle

This is the only oddball of the bunch. The Fed backed off 75bps and avoided a total collapse of rates (this is the scenario I was originally hoping the Fed could pull off this time). But note how the delta between expectations and actual was still more than 3%.

1988 Tightening Cycle

The market expected rates to be flat, but the bottom fell out.

In November, both the market and the Fed didn’t think it would see hikes this year.

Why should we believe they are any better at forecasting cuts?

Week Ahead

Hugely important market moving inflation readings this week. PPI on Wednesday, CPI on Thursday, and inflation expectations on Friday.

We also get the FOMC Minutes from the last meeting, though I’m not sure it will reveal anything new.