Buy Out Your Floor While You Still Can

As floating rates have risen, many lenders have increased index floors when making new loans or modifications to existing debt. If floating rates remain above the floor, this is a non-event for the borrower, but it does increase the probability of missing out on interest savings if the Fed cuts sooner or more than expected. If you have a floating rate loan with a higher imbedded floor, you might wind up wishing you had bought out that floor over the next couple years.

In case you didn’t already know you could buy out the floor on your floating rate loan, check out our resource on the mechanics of buying out the floor.

Rate Expectations

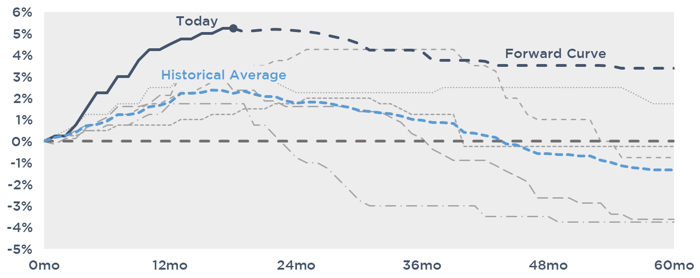

The following graph compares the path of floating rates this cycle compared to the previous five. With the exception of one case, the Fed cut rates dramatically an average of about nine months after they stopped hiking.

Further, notice how much more quickly rates have climbed compared to previous cycles.

Today’s forward curve suggests that floating rates will eventually begin to fall but level off above 3.50%. But will the Fed actually be able to maintain a higher rate environment for longer this time around, or will they wind up cutting dramatically like cycles prior?

As it turns out, the forward curve usually suggests that the Fed will be able to hold rates higher for longer, but that’s historically not what actually plays out.

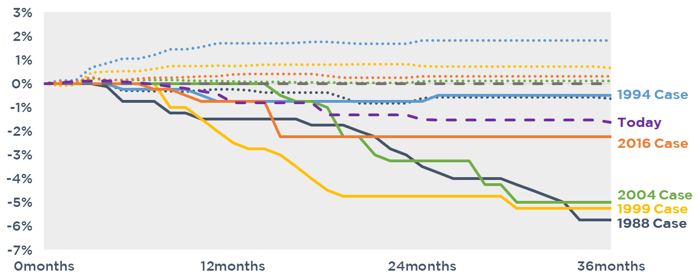

In the chart below, the dotted lines represent what markets were expecting floating rates to do at the time of the last hike in the past five Fed cycles. The solid lines are where the Fed actually took rates.

If this Fed cycle behaves in line with historical trends, we could be in a materially lower rate environment over the next couple years.

Impact on Floating Loans with Floors

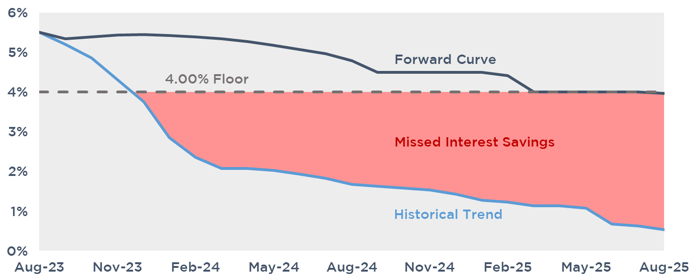

To illustrate how this could impact your deal, let’s assume you have a $50mm floating rate loan with an imbedded floor at 4.00% and you plan to be in the financing for the next couple years.

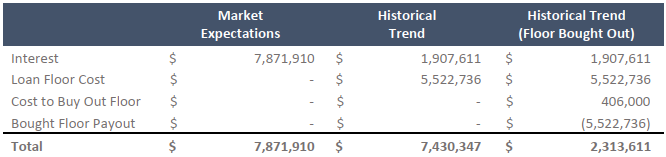

If rates follow expectations (dark blue line) and today’s forward curve actually plays out, you’d be indifferent to the loan floor since floating rates are expected to remain at or above 4.00% over the next couple years.

However, if rates follow a path in line with historical trends (light blue line), you would miss out on more than $5mm in savings from floating lower. The table below compares your interest expense assuming rates follow expectations against historical trend with or without buying out the floor.

Cost of Buying out the Floor

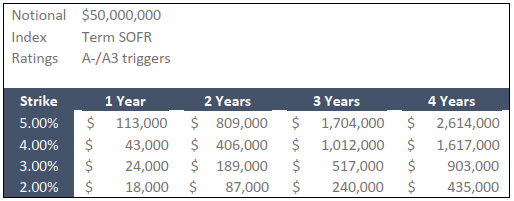

The cost of buying out the loan floor will vary depending on the specific terms of your deal, but to help provide an order of magnitude on the cost, we’ve outlined some generic pricing below.

You can even get creative with floors by buying a higher strike (e.g. 4.00%) and selling back a lower strike (e.g. 2.00%). This trades off some of the protection but lowers cost, which can help make this elective hedge more approachable. To dive into how this structure works in greater detail, read about flooridors here.

Conclusion

For help determining if buying out the floor makes sense for your deal or for more specific floor pricing, reach out to the experts at PensfordTeam@Pensford.com or (704) 887-9880.