Are Collars the Solution?

Overview

The idea of a collar as a hedging tool often comes up when caps become expensive. Get a cap with no out of pocket today - what’s not to love? At first glance borrowers are often interested but there are risks to consider before locking one in.

The Mechanics

First and foremost, collars are generally only an option if the lender is also the hedge provider. That way they can secure the credit exposure using the real estate as collateral.

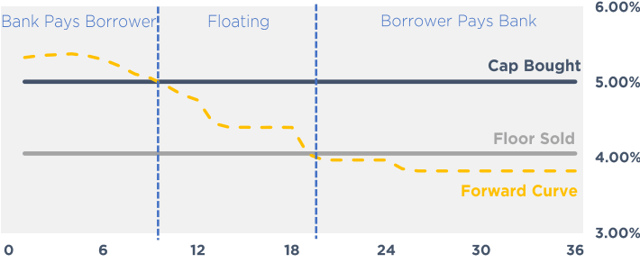

As a refresher, a collar is the simultaneous purchase of a cap and sale of a floor at a lower strike. Like a vanilla cap, the bank reimburses the borrower when rates exceed the cap strike. On the flip side, the borrower owes the bank whenever rates are below the floor strike. Collars are often structured as costless, meaning the value of the cap purchased is equal to the value of the floor sold.

Below are a few example structures for costless collars based on today’s market.

Based on the forward curve, the only collar with projected payout on the cap is the buy 5.00%, sell 4.05% structure. However, the floor is also projected to come into play for the second half of the term.

If rates are higher than expectations, the borrower owes little to nothing under the floor and effectively gets a cap for free. If rates are at or below expectations, the borrower will end up paying out under the floor. If rates are well below expectations the total cost incurred could well exceed what the cap would have cost.

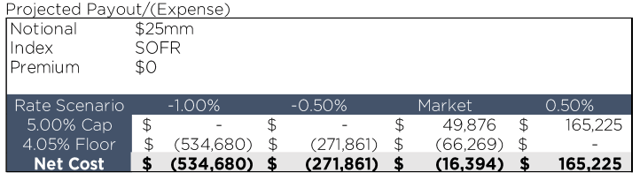

That said, if there’s anything we can be certain of, it’s that the forward curve won’t hold true for one reason or another. See below for the projected net cost/benefit of the buy 5.00% cap/sell 4.05% collar with a $25mm notional under different rate environments.

For reference, a vanilla 5.00% 3 year cap would cost ~$315k, meaning rates would need to average ~0.60% below expectations over the 3 year period for the floor expense to exceed the upfront cost of a cap.

Keep in mind the above doesn’t take into account the potential cost of an early breakage. If rates fall and the borrower prepays, the value of the floor (liability) could exceed the cap (asset), meaning a breakage would be due.

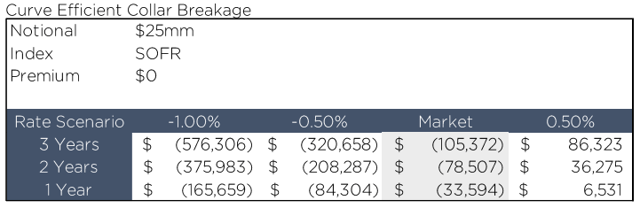

For instance, if the borrower wanted to terminate with 2 years remaining and rate expectations fell by 1.00% from today, then the breakage would be ~$550k. We’ve outlined scenarios of what the potential breakage could be for the buy 5.00%, sell 4.05% collar below

The breakage on a collar is generally less burdensome than that of a swap since the value of the cap helps to offset some of the floor’s liability.

A Curve Efficient Collar

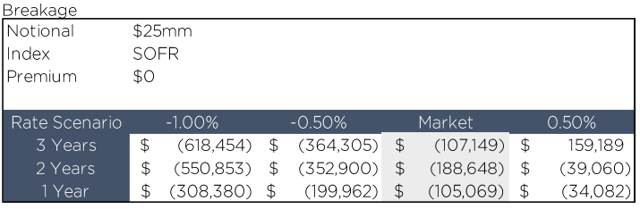

As our savvy readers know, hedges are very customizable. By adjusting the strikes on the cap and floor to move with the forward curve, a collar might look like a viable solution.

For example, were a borrower to execute a costless collar where the strike on the cap is always 1.00% above the forward curve, they could sell a floor that is 0.50% below the forward curve to offset that cost.

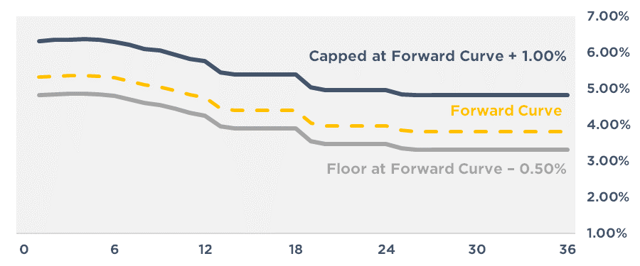

By structuring the collar in this manner, the borrower is getting a constant level of protection against rising rates relative to the forward curve for no cost, and positioning the floor such that there’s a buffer in case rates end up below expectations. The below outlines breakages under different rate scenarios for a 3 year buy 1.00% above the forward curve, sell 0.50% below the forward curve collar.

Considerations

In addition to the liability of the floor and potential for breakage, there are a few other considerations to evaluate.

Speculating on Rates – A costless collar is essentially buying a cap that’s paid for with the liability of the floor. A collar trades the known cap premium for an unknown floor liability.

Missing out on Floating Lower – If rates fall, a borrower could miss out on floating lower if SOFR is less than the floor. Some borrowers may be fine with the prospect of paying a higher rate as the upfront cap cost was reduced, but others prefer to retain all the benefit of floating lower.

The Loan Floor – Do not overlook this one. If the financing already has a floor, then you could potentially end up with two floors – one on the loan floor and one on the collar floor. To avoid this scenario, buying out the loan floor might be required which can negate the entire reason for pursuing a collar.

Conclusion

As with any hedge strategy, the business plan and risk tolerance will play a major factor in determining if a collar makes sense.

For example, a collar may be viable for a construction project where preventing a higher interest expense during the development phase is more important than capturing all the benefit of floating lower. Further, the potential prepayment penalty likely isn’t a consideration since construction financings are rarely prepaid.

At the same time, a collar may not make sense on a value-add project with short term debt where uncertainty on the disposition makes the prospect of a prepayment penalty too big a risk.

Each project is unique, and collars certainly aren’t a strategy that can apply to every deal, but when a collar is an option it’s important to take the time to weigh the pros and cons.

If you’re exploring whether a collar makes sense, reach out to us at pensfordteam@pensford.com or (704) 887-9880.